Introduction

After some turbulent years in politics for both the major parties, and despite the economic success of the current Government, the bookmakers are predicting that the Labor party will win the next Federal election.

Over the last 18 months, the Labor party has been quite vocal in its desire for tax reform with many of these reforms aimed squarely at what it calls the “upper end of town” and catching many of the “lower and middle end of town” in the process, the very same people they say they are trying to help “get ahead in life”. Many of these policies will affect you, our client base and we thought prior to the election we should bring you up to speed on the changes that will come our way should the bookmakers be correct.

Please note that none of these policy announcements are yet law and, depending on the makeup of our next Government and Senate, may not become law. We also note, because they are policy announcements, the fine details of the policies will not be known until draft legislation is released. Given the Labor party under Bill Shorten has been quite vocal in being absolutely committed to its promises, should they win the election, we expect the majority of these policies to be legislated.

Investment Policies

Changes to taxes around investment income are some of the most publicised of the policies announced by the Labor party and for many of you will have the most significant impact.

Franking Credits

The proposed changes to the refundability of franking credits are the most controversial of the Labor party’s policy announcements and there has been much discussion surrounding them in the media. The changes are targeted at self-funded retirees and self-managed superannuation funds (SMSFs), or as the Labor party want you to think – the “upper end of town”.

There are several exclusions for charities and not-for-profits as well as a limited exclusion for pensioners and SMSFs. We refer to the exclusion for pensioners and SMSFs as being limited as it is a misconception being perpetuated by the media that this exclusion will apply to all SMSFs with members in receipt of the age pension. As the policy announcement currently stands this exclusion will only apply to those SMSFs with members that were in receipt of a means-tested government pension as at 28 March 2018. Should you reach age pension age after this date, then the exclusion will not apply and your SMSF will not be entitled to a refund of franking credits.

There are also many grey areas with this policy and how the limitation of franking credit refunds will interact with other areas of tax law.

Negative Gearing

Another well publicised policy is the abolition of “negative gearing”. Negative gearing occurs when an investment is purchased using a loan and the interest and other expenses associated with the investment exceed the income earned from the investment in a particular income year. This loss is then available to be offset against other income earned by the taxpayer such as salary and wages, interest, and business income. It is most commonly associated with rental properties however it is also a common strategy for investors when purchasing shares or other securities.

The Labor party want to restrict taxpayers’ ability to offset the loss from negatively geared investments against other income. The loss will be quarantined and offset against future investment income. The policy announcement however, does not contain the detail around how this quarantining will work – will the losses be quarantined from salary and wages income only? Will the losses be quarantined to a particular investment class or asset – for example will you be able to offset your rental property losses against income from other investments such as dividends or interest? Or if you have two rental properties and one is geared, will you be able to offset the losses from property 1 against the profits from property 2, or will the losses from property 1 be quarantined until such time as the property makes a profit?

The Labor party have indicated that investments in new residential property will be excluded from this policy. They have also indicated that the policy will not apply retrospectively, so investors of existing negatively geared properties should continue to be able to offset the loss against other income.

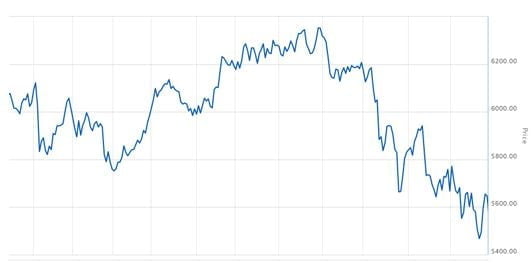

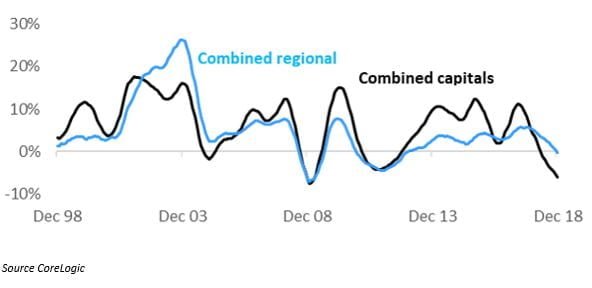

The Labor party’s intent behind this policy is aimed at housing affordability and helping to “level the playing field for first home buyers competing with investors”. However, combined with the slump in the property market and the proposed changes to the Capital Gains Tax discount (see next section) many economists are concerned about the impact this policy may have on property prices. This impact is further compounded by the high levels of debt incurred to purchase properties when the market was booming that may not meet loan-to-value ratios should the property market slump further.

The policy is intended to apply from 1 January 2020.

Capital Gains Tax

Another policy change from 1 January 2020 is the Labor party’s proposed changes to the Capital Gains Tax (CGT) discount for individuals. Currently where CGT assets have been held for more than 12 months, the individual is entitled to a discount of 50%. The Labor party is proposing to reduce the discount to 25% for any assets acquired after 1 January 2020. The current 50% discount will continue to apply for assets acquired before 1 January 2020.

The discount for superannuation funds remains unchanged at a discount of one third.

Whilst no detail has been released, there have been indications that small business assets will be exempt from this policy change.

Superannuation Policies

In the early 2000’s successive Howard Governments created a generous superannuation system that was tax free in retirement and aimed at reducing the reliance on the Age Pension. With the fall in Government revenues since the Global Financial Crisis, subsequent Governments have introduced a raft of policies clawing back the generosity of the Howard Government and shifting the superannuation system from being an alternative to the Age Pension to one of supplementing the Age Pension. For someone wanting to fully self-fund their retirement it is more likely that they will have to bear an increasing tax burden as the Labor party is proposing to tighten the superannuation system further.

Superannuation Contributions

Currently an individual may make a non-concessional contribution of $100,000 p.a. subject to age restrictions and the $1.6 million cap on superannuation fund balances. In addition, if you are under the age of 65 you may access the bring-forward rule and, subject to the $1.6 million cap, combine up to three years of contributions caps to make contributions of up to $300,000 over a fixed three-year period.

The Labor party is proposing to reduce the annual cap to $75,000 and the bring-forward cap to $225,000 which will severely hamper the ability of individuals to transfer money into superannuation.

These types of contributions are commonly used by individuals nearing retirement to make catch up contributions at a point in time when it is common to have a higher disposable income. Common sources of funds are from the sale of investments, inheritances, redundancy payments, savings from finally having paid off the mortgage etc. The reduction in the cap will limit the ability to make large contributions to super and leave more money outside of the superannuation system and subject to higher individual tax rates.

Tax Deductible Superannuation Contributions

Until recently, it was only the self-employed or those whose main source of income was from investments that could make a personal superannuation contribution (subject to the concessional contribution cap of $25,000) and claim a deduction for it in their personal tax return. For salary and wage earners, they were reliant on their employer offering a salary sacrifice arrangement, and many do not, to make additional deductible contributions to their superannuation fund. In the 2017 budget the Liberal/National party evened up the playing field by allowing all individuals to make deductions in their personal tax returns for superannuation contributions.

The Labor party proposes to remove this concession and revert to the previous rules which only allowed an individual to claim a deduction for personal contributions if less than 10% of their total adjustable income came from employment sources.

Catch-up Concessional Contributions

In the 2017 budget, the Liberal/National party introduced the concept of Catch-up Concessional Contributions for individuals with low superannuation balances. This concession applies to individuals with superannuation balances of less than $500,000. Under the concession, individuals could carry forward up to five years of their unused Concessional Contribution caps (a maximum of $25,000 p.a.).

The Labor party proposes to abolish these changes as they considered the changes an advantage to higher income earners.

Superannuation Guarantee Changes

There are three main changes the Labor party is proposing to make in relation to the Superannuation Guarantee:

- Phasing out of the $450 threshold. Currently superannuation guarantee is only required to be paid in respect of wages earned where the employee has earned more than $450 in the month. The Labor party proposes to phase this out by reducing the threshold by $100 each financial year between 2020 and 2024. This is a positive change and is targeted at boosting the retirement incomes of low income earners.

- Superannuation Guarantee is currently not required to be paid in relation to amounts received under the Federal Government’s paid parental leave scheme. It is commonly known that women’s superannuation balances are significantly smaller than men’s by the time they reach retirement age and that a contributing factor to this is the time women spend out of the workforce as the primary carer to babies and young children. This change will help boost the retirement income of women.

- Both the Labor and Liberal/National parties are committed to increasing the base rate of Superannuation Guarantee from 9.5% to 12%. The rate is currently set to increase from the 2021/22 financial year by 0.5% per year until it reaches 12% in the 2025/26 financial year. The Labor party has expressed a desire to increase the superannuation rate as soon as practicable.

Limited Recourse Borrowing

Currently there are limited circumstances where an SMSF can borrow to acquire a single asset, such as residential investment properties. The borrowing arrangement by which the SMSF can borrow is called a Limited Recourse Borrowing Arrangement (LRBA). According to the Labor Party, since 2007 the number of SMSFs using LRBAs has increased by over 800% and is contributing to crowding out first home buyers.

The Labor party intend prohibit an SMSF to borrow under these arrangements for the purposes of investing in residential property, with the changes to occur prospectively. The Labor party’s view behind this policy is that by removing the ability to borrow, they will limit the number of SMSFs that can acquire residential property which in turn will assist to even the playing field for first home buyers.

Age Pension Age

Both the Labor and Liberal/National parties are committed to increasing the Age Pension age from 65 to 67 by 1 July 2023. The current Liberal/National government was forced to abandon its plans to increase the Age Pension age to 70 and the Labor party will not pursue a further increase to the Age Pension age.

Business & General Changes

Targeting high income earners

The Labor party have two policies that are targeting high income earners:

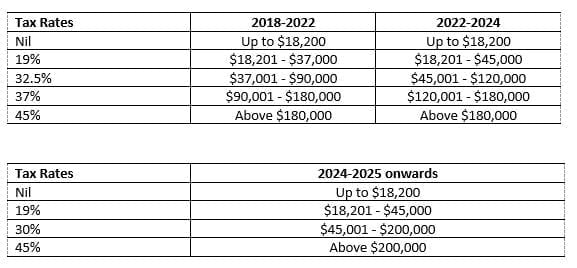

- Re-introducing the budget repair levy for those earning over $180,000. This will effectively increase the highest marginal tax rate from 45% (47% including the Medicare Levy) to 47% (49% including the Medicare Levy).

- Reducing the Division 293 high-income super contribution threshold. Currently individuals whose adjusted taxable income exceeds $250,000 pay an additional 15% on concessional superannuation contributions. The Labor party proposes to decrease this threshold to an adjusted taxable income of $200,000.

A cap on tax deductions for managing your tax affairs

The Labor party is proposing to limit the amount a taxpayer can claim for managing their tax affairs to $3,000 p.a. which would indicate that the Labor party is trying to curtail those who make inappropriate claims and in particular, the very upper end of town, as Mr Shorten’s 2017 budget reply speech referred to a number of Australians earning more than $1 million that have paid no tax because they used “clever tax lawyers” and the deductions paid to their “accountants” averaged over $1 million.

The ATO have come out in defence of these type of large claims, indicating that ordinarily when a taxpayer is making a claim of that magnitude it is generally comprised of a large amount of general interest charges that has arisen due to a settlement arrangement with the ATO in relation to a tax debt that exceeded $1 million.

As the law currently stands, all taxpayers regardless of the amount or type of income they earn are permitted to claim the costs associated with managing their tax affairs. These costs include, but are not limited to, fees paid to tax agents for preparation of tax returns and activity statements, to tax agents/lawyers for advice as well as representation at the tax tribunal or in court on tax related charges and for interest on loans used to pay tax debts.

It is unclear whether the Labor party’s policy will include an exemption for businesses, but the policy is clearly targeted at individuals, partnerships, trusts and superannuation funds.

The services provided by these deductible costs are a vital part of our tax system. Our tax laws are complex, and without this advice many individuals and businesses cannot make informed decisions and may inadvertently breach many sections of the law and or be unable to calculate the appropriate amount of tax to pay. On the flip side, the ATO also relies on tax agents and lawyers to provide these services to maintain the integrity of the tax system which in turn helps keep Federal funding required by the ATO to a minimum.

Taxation of Trusts

Discretionary trusts are commonly used as a structure for businesses and investments due to the higher level of asset protection they allow. They also have the added benefit of allowing taxpayers the flexibility of distributing income to a variety of individuals or other entities. As the trusts are not taxed themselves, but rather the individual or entity to whom the income has been distributed, the income is then taxed at the marginal tax rate of the individual or entity. This flexibility provides an obvious ability for tax groups to structure their tax affairs to take advantage of the marginal tax rates of the lower earning members.

Clearly there are some taxpayers out there who have abused the generosity of these laws, and reform of the taxation of trusts has long been on the agenda of both the accounting industry and the ATO. However, instead of undertaking a broad tax reform of the taxation of trusts, the Labor party is proposing to introduce a minimum tax rate of 30% on all distributions to beneficiaries over the age of 18.

This is another policy announcement the Labor party has made that has little detail to accompany it. We know that there will be exclusions for special disability trusts, deceased estates, fixed trusts and charitable trusts, but not the detail. Nor have the Labor party indicated whether businesses operating via a discretionary trust will be provided with a mechanism to allow for a restructure with no tax disadvantage.

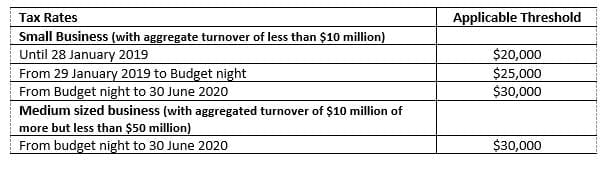

Investment Guarantee

There currently exists for small-medium businesses with a turnover of less than $10 million the ability to claim an upfront deduction for capital expenditure where the total amount per item is less than the instant asset write-off threshold. The instant asset write-off threshold is legislated each year, and for the last couple of years has been set at $20,000 p.a. The Labor party proposes to permanently set this at $20,000 p.a. whereas the Liberal/National party have proposed a $25,000 cap to be reviewed each year.

Business Dealings and Tax Havens

We all know tax havens exist, and they have been used extensively by large corporations and high net wealth individuals to minimise the amount of tax they pay. There is currently an International Agenda to increase the transparency of tax havens as well as ensure that multi-national companies and High Net Wealth Individuals pay their fare share of tax to the countries in which they have earned their profits.

The Labor party are aiming to introduce several measures aimed at minimising the use of Tax Havens and increasing the transparency of such use within the Australian corporate environment.

The first of these measures is to deny a tax deduction for any work- or business-related travel to known tax havens. Whilst no detail is available, it is presumed that this will apply regardless of whether it is travel for legitimate business purposes, for example, to negotiate an export contract.

The second measure is to include changes to the Corporations Act 2001 by making it mandatory for companies to report to shareholders if the company is undertaking any business in a tax haven.